Key Benefits:

LEY NÚM. 21.516

PUBLIC SECTOR FOR THE YEAR 2023

Bearing in mind that the H. National Congress has approved the following

Bill:

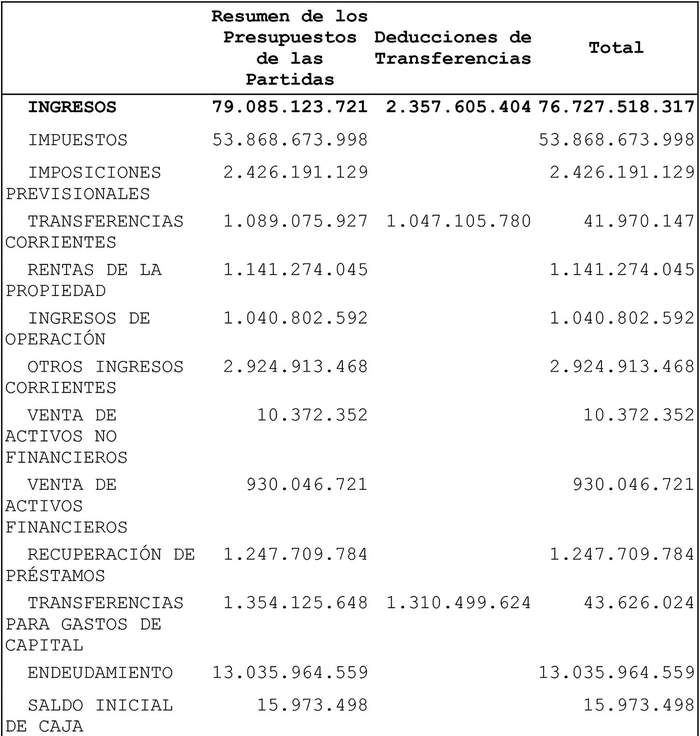

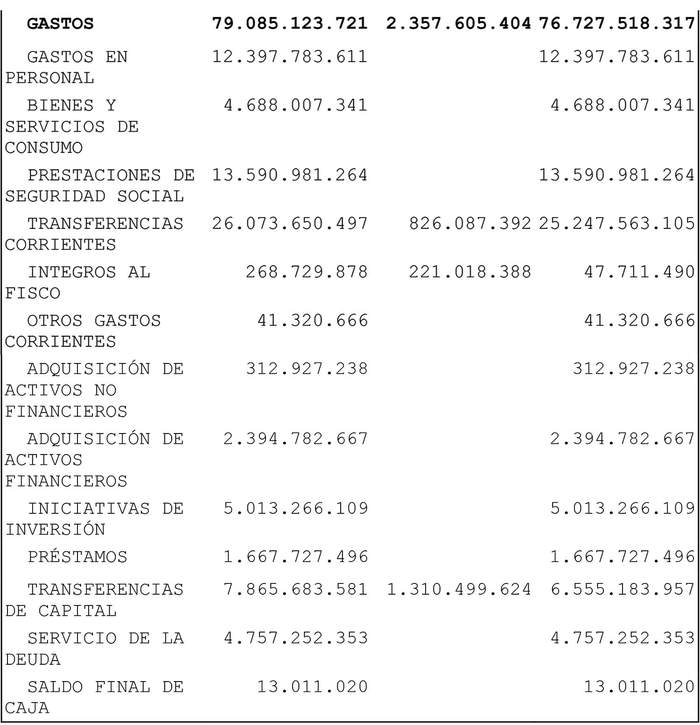

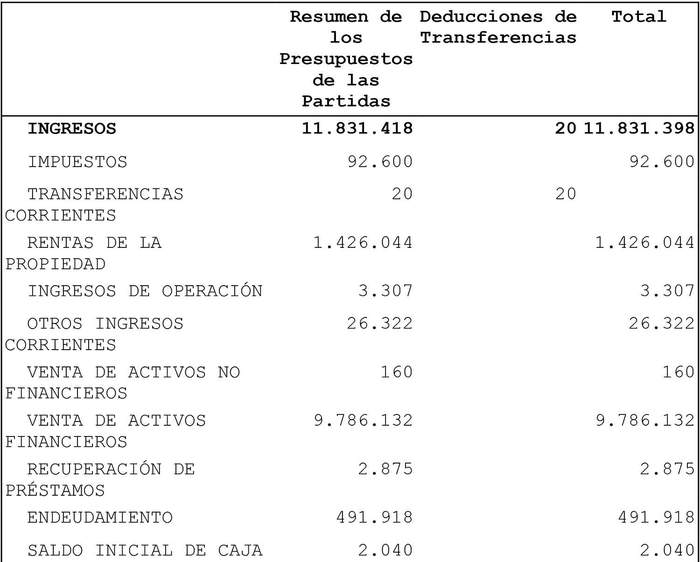

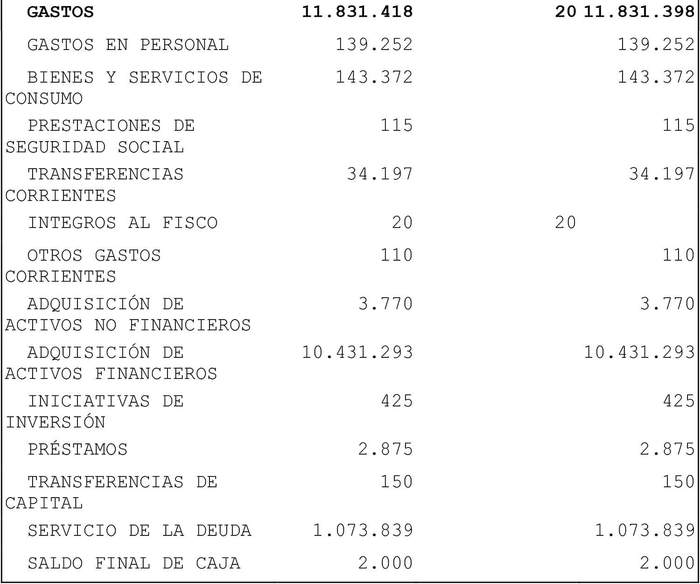

"Article 1.- Approve the Public Sector Income and Expenditures Budget, for the year 2023, according to the detail indicated:

National currency

Thousands of $

Foreign Currency Converted to Dollars

Thousands of US$

Article 2.- During the year 2023, the President of the Republic may grant the guarantee of the State to the credits they contract or to the bonds issued by public sector companies, and state universities, up to the amount of US$500,000 or its equivalent in other foreign currencies or in national currency.

The authorization granted to the President of the Republic shall be exercised by one or more supreme decrees issued through the Ministry of Finance, in which the specific destination of the obligations to be contracted shall be identified, and the sources of the resources from which the service of the debt must be indicated. These decrees may include the information requirements and other actions to be carried out by the companies and universities specified while the credits or bonds are in force.

The guarantees granted by the State in accordance with this article shall be extended to the capital, readjustments and interests deriving from the above-mentioned credits and bonds, commissions, currency exchange contracts and other expenses, irrespective of their present or future denomination, until the actual payment of such obligations.

The companies referred to in paragraph 1 above, in order to obtain the state guarantee indicated, must, as appropriate, subscribe to a programme agreement with the Company System Committee of the Production Development Corporation, which will specify the objectives and expected results of its operation and investment programme, in the manner established by instructions of the Ministry of Finance. These conventions shall be applicable to the second subparagraph of article 2 of the Law No. 19.847.

Authorize the state universities to hire, during the year 2023, loans for the financing of labour capital and remuneration, -with the exception of remunerative increases-, refinancing of liabilities, and/or investment projects, for periods of up to twenty years, so that, with the amounts contracted, the level of total indebtedness in each one of them does not exceed one hundred percent of their assets. Debt service will be carried out on the basis of the assets of the same state universities that hire them. These loans must have the prior visa of the Ministry of Finance. However, the borrowers will not directly or indirectly compromise the credit and financial responsibility of the State.

The response by the Ministry of Finance shall be made within the 90-day period of receipt, in accordance with the respective records. The analysis of the debt-patrimonial relationship will be carried out considering the quarterly financial statements of the respective state university corresponding to the quarter prior to the application.

Recruitment of the loans authorized to state universities shall not be subject to the rules of the Law No. 19.886 and its rules of procedure. In any case, universities should call a public proposal to select the financial entities that will grant them the or the loans.

Electronic copy of the contracts for the loans, indicating the amount and conditions under which they were signed, in addition to a report specifying the objectives and expected results of each indebted operation, will be sent to the Ministry of Education and the Joint Special Budget Commission within 10 days of their recruitment.

Article 3.- Authorize the President of the Republic to enter into obligations, in the country or abroad, in national currency or in foreign currencies, up to the amount of US$15,000.000 thousand which, as a matter of indebtedness, is included in the General Income of the Nation.

Authorize it, in addition, to contract obligations, in the country or abroad, up to the amount of US$2,000,000 thousand or its equivalent in other foreign currencies or in national currency.

For the purposes of this article, bonds and other documents may be issued and placed in national or foreign currency, which may bear the signature of the General Treasurer of the Republic. Part of the obligations under this authorization that is amortized within the budget period 2023 and those that are contracted to make full or partial advance payment of debts established in previous periods, deducted the amortizations included in this law by 2023, shall not be considered in the computation of the margin of indebtedness set out in the preceding paragraphs.

The authorization granted to the President of the Republic shall be exercised by supreme decrees issued through the Ministry of Finance, in which the specific destination of the obligations contracted shall be identified, indicating the sources of resources from which the service of the debt must be made. Copies of these decrees will be sent to the Senate Treasury Commissions and the Chamber of Deputies within fifteen days of their total processing.

Article 4.- In accordance with the provisions of paragraph 3 article 26 of Decree Law No. 1.263 of 1975only under the authorization granted by law can the amount of the net value of the amounts for the Expenditure in personnel, consumer goods and services, social security benefits, current transfers and other current expenses included in Article 1, be increased in national currency and foreign currency converted to dollars.

It shall not rule on the provisions of the preceding paragraph with respect to the greatest egresses arising in the items referred to in Subtitles which are legally excelable in accordance with the article 28 of Decree Law No. 1.263 of 1975and glosa 01, Supplementary Operations Programme of this Law, or the increases resulting from the allocation of higher initial cash balances, except for the Public Treasury Partition, for the sale of financial assets, in own income allocated to benefits or expenses, in resources obtained from concursable funds of public entities or under the provisions of the article 21 of Decree Law No. 1.263 of 1975. The higher actual expenditures or increases available for such concepts, in the amount exceeding the budget, will increase the maximum amounts indicated in the preceding subparagraph, as appropriate.

Equal legal authorization shall be required to increase the sum of the amounts approved in Article 1, of the Non-Financial Assets Acquisition Subtitles, of the Investment and Capital Transfer Initiatives to agencies or companies not included in this Law, in a amount exceeding 10% of that amount, unless the increases are financed by budgetary reassignments from the maximum amount established in paragraph 1 of this Article or by the incorporation of greater opening cash balances, Increases from the above-mentioned reassignments will decrease the maximum amount set out in paragraph 1 of this article in the same amount. Contributions to each of the companies included in this Act may be up to 10%.

Article 5.- Replace, during the year 2023, the application of letter (d) article 87 Law No. 18,834, Administrative Statute, the consolidated, coordinated and systematized text of which was established by the Decree No. 29 of 2004 of the Ministry of Financeregarding the compatibility in the performance of plant charges governed by that law with the appointment in contractual charges. In addition, during the year 2023, alternate staff may not be recruited in the positions of the plant that are not held by the incumbent on the application of the previous mechanism.

The provisions of this article shall not apply to persons who are using such exceptions at the time of publication of this law.

Article 6.- The public proposal or tendering shall be mandatory for investment projects and programmes and basic studies to be carried out in 2023, when the total amount of these, contained in the identification decree or resolution, is higher than the equivalent in pesos of one thousand monthly tax units in respect of investment projects and programmes, and of five hundred monthly tax units in the case of basic studies, except for exceptions in emergency situations provided for in the relevant legislation. In the case of the amounts included in the headings Ministry of Public Works and Ministry of Housing and Urbanism, these amounts will be ten thousand monthly tax units for investment projects and programmes and three thousand monthly tax units in the case of basic studies.

Where the respective amount is less than those specified in the preceding paragraph, the award shall be made in accordance with the procedure established in the preceding paragraph. Supreme Decree No. 151 of 2003 of the Ministry of FinanceOr the one who replaces it.

Contractors and subcontractors that perform works or provide services financed from fiscal resources, which violate labour and forecasting laws, which must be determined by the competent authority during the development of such contracts, shall be qualified with a poor note in the area of contract administration, without prejudice to the appropriate administrative penalties. This qualification will become part of the respective records and will be considered in future tenders and awards of contracts.

Private institutions, whatever their nature, at the time of contracting with the State must accompany a certificate of compliance with labour and remuneration obligations. In the event that the private institution is incorporated into any register for non-performance or remuneration, or does not accompany the said certificates at the appropriate time, it shall not be able to hire the State until the breach affecting it is subsidized.

Article 7.- In the decrees containing transfers, which have been laid down in this law or are believed by virtue of article 26 of Decree Law No. 1.263 of 1975, with charge to items 01, 02 and 03, of Subtitles 24, Current Transfers, and 33, Capital Transfers, of this budget, for public bodies and services, may indicate the use or destination that the receiving institution shall give to the resources, conditions or modalities of its refund and the information that regarding its application shall be referred to the agency that is determined.

The balances of resources transferred not used by the recipient agencies shall be entered by the receiving entity of the transfer to general income of the Nation by 31 January of the following year.

Those transfers included in subheading 24, which constitute global allocations to units of a Service or to programmes implemented in full or in part by the Service, shall be disaggregated prior to the budget execution in the different concepts of expenditure, with a visa from the Budget Directorate. A progress report, together with budget performance information, should be forwarded monthly to the latter. Such breakdown shall constitute the maximum authorization of expenditure in the respective concepts, without prejudice to the modifications made to it through the same procedure. The visa may be made on the date of publication of this law. However, the above-mentioned cost concepts may not include resources for personnel and consumer goods and services, unless authorized by express standard in the respective budget. In addition, staff recruited from such resources shall not be part of the staffing of the Service.

Article 8.- All payments to suppliers of goods and services of any kind made by State Administration bodies during the year 2023, including those related to construction contracts or infrastructure, shall be made through electronic transfer of funds. In addition, their recognition in budgetary implementation should be fully implemented Act No. 19.983which regulates the transfer and gives executive merit to copy the invoice. To this end, State Administration bodies should require the necessary information to make such transfers to appropriate suppliers, as part of the recruitment process, and to comply with the general technical instructions issued by the Budget Directorate.

Article 9.- Prohibit public bodies and services, the acquisition, construction or lease of buildings to house their staff. This prohibition shall not apply to the programmes on this subject incorporated in the budgets of the judiciary, the Ministry of National Defence, the Carabineros de Chile, the Chilean Police of Investigations, the Gendarmería de Chile and the regional investment of regional governments regarding housing for education and health personnel in remote areas and rural locations.

Article 10.- Notwithstanding the maximum number of staff or weekly hours set out in this budget to public services, the number or weekly hours of any of them may be increased from the decrease of another, or from the same amount of fees, by decree issued in the manner provided for in the article 70 of Decree Law No. 1.263 of 1975. In no case may the maximum or number of hours per week be increased for the entire service of the respective ministry.

In addition, the rates of fees set out in this budget may be increased to public services and budget programmes, from the decrease of another, or from the same amount of contractual quotas, without increasing the fees quotas for the entire service of the respective ministry.

Without prejudice to the provisions of the preceding paragraph, during the first quarter of the year 2023, at the request of the respective services and institutions of the Public Sector, the Minister of Finance may modify the maximum limit of persons contracted to fees, set in the respective glows associated with subtitles 21 and 24.

Article 11. Public bodies and services may recruit staff who replace staff and staff who, for any reason, are unable to perform their duties for a period exceeding thirty days. Contracts for replacement work may not be valid for more than six months, shall not be charged to the respective maximum staffing level and may only be made upon authorization by the Budget Directorate, which shall verify the appropriate budgetary availability. Such authorization shall not be required, in the case of maternal, post-natal parental leave and/or leave for serious child disease less than one year, but must be informed to the Budget Directorate.

Article 12.- Public bodies and services budgeted by the Decree Law No. 1.263 of 1975, excluding the National Congress, the Judiciary, the Public Prosecutor ' s Office and the Office of the Comptroller-General of the Republic, will require prior authorization from the Budget Authority to acquire any title, to take on lease or to agree that they are provided, through any type of contract, all motorized vehicles intended for the ground transportation of passengers and/or cargo, which are not part of a Coordinated Purchase Process communicated by the Public Procurement Directorate.

The above-mentioned public bodies and services will also require this authorization, with respect to investments and expenditures in new projects, continuity or trawling in Information and Communications Technologies (ICTs), when they have not been approved during the corresponding EVALTIC process, or are not part of a Coordinated Purchase Process reported by the Public Procurement and Procurement Directorate and authorized by the Budget Directorate.

It is exempted from the provisions prior to the National Intelligence Agency, the Armed Forces and the Order and Public Security Forces, only in respect of the purchases of military material, armoured police, institutional color vehicles referred to in the Regulations of Vehicles for Carabineros of Chile No. 20 and its complementary directive and those associated with intelligence work.

The Budget Authority shall establish the technical parameters, maximum amounts, and shall provide specific instructions with respect to the authorizations indicated in the preceding paragraph and those required to conclude the contracts specified in the preceding paragraph. article 14 of the Act No. 20.128on fiscal responsibility, and may establish mechanisms for the procurement of products or the procurement of services, and any other form or procedure that it may determine.

Article 13.- The proceeds of sales of tax real estate that are not intended for the application of the provisions of the article 56 of Decree-Law No. 1.939 of 1977which takes place during the year 2023 the Ministry of National Property, and the contributions received in that year for sales made in previous years, shall be temporarily incorporated as a budgetary income of the Ministry. These resources will target the following objectives:

(a) 65 per cent to the Regional Government of the region in which the alienated property is located for its investment programme.

(b) 10% to the Ministry of National Property.

(c) 25 per cent for tax benefit, which will enter the national general income.

The rule established in this article shall not apply to the sales made by the Ministry to public bodies and services, or to companies in which the State, its institutions or companies have a capital contribution equal to or greater than 50%, intended to meet the needs of the acquirer.

However, if the companies referred to in the preceding paragraph dispose of all or part of the real estate acquired by the Ministry of National Property within one year of the date of registration of the domain to its name, the Fisco will provide the respective regional government with 65 per cent of the price paid to the said ministry, or the corresponding proportion if the sale is partial.

In the case of the properties of the Armed Forces, the applications from disposal resources will be incorporated annually in the Budget Act, in the respective chapters of the National Defence Ministry, and the estimated income and expenditure will be identified in each case. Resources can only be used in infrastructure projects, including social investment projects, such as inhabitability and improvement of the living conditions of all staff members of these institutions, and in military infrastructure projects.

Article 14.- The organs of the State governed by this law, or those specified in the following numerals, shall inform the Joint Special Committee on Budgets, with a copy to the National Congress Library, as follows:

1. A monthly schedule, disaggregated by budget and subtitles, of expenditure for the current year, to be sent during the month of March, and updated in the month of July, together with an explanation of the main changes that occurred during the first semester and recorded in that update.

2. Copy of reports derived from studies and research under assignment 22.11.001, within one hundred and eighty days of receipt of its final report.

3. By 31 March, by means of an electronic document that allows the processing of your data, the payroll of the studies and the investment projects contemplated in Subtitle 31, including the projects granted, disaggregated by budgetary program and region, with the identification of new or drag projects, annual budget, date of start and end of the work.

In the same format and with the same disaggregation, it will be sent quarterly, thirty days after the end of the respective quarter, the current budget, the state of progress of the studies and the state of physical and financial progress of the projects, as well as the modifications that have experienced in the reported period.

4. Each regional government should report the basic studies, projects and investment programmes they will undertake in the region and have identified in accordance with the provisions of the article 19 bis of Decree Law No. 1.263 of 1975. Such information shall include the name of the study, project or program, its amount and other characteristics, and shall be forwarded within thirty days of the end of the month of total processing of the respective decrees.

5. The Company System Committee of the Production Development Corporation or whoever succeeds or replaces it, will submit a quarterly financial report of the State companies, and of those in which the State, its institutions or companies have a capital contribution equal to or greater than fifty percent, which will comprise a consolidated balance by company and state of results, at a consolidated level and by company. The report shall be forwarded within fifteen days of the expiration date of the respective filing period set by the Financial Market Commission. The same obligation will have National Television of Chile and the National Copper Corporation of Chile (CODELCO), which will have to submit quarterly financial reports directly to the Joint Special Budget Commission.

6. The amount executed for publicity and dissemination, charged to Subtitle 22, item 07, in which it has incurred, by budget programme, in the format to be defined by the Ministry General Secretariat of Government. In addition, you will report the detail of spending on advertising, dissemination or public relations in general, distinguishing between advertisements, promotion in newspapers, radios, television, digital media, cinemas, theaters, magazines, contracts with advertising agencies and/or exhibition services and indicating the suppliers of each of them, if they have a clear local identification and if they belong to a holding, conglomerate or communication chain. In addition, the number of executing entities of such activities, their procurement mechanism and the amount awarded, disaggregated by programmes, will be attached. This information will be sent quarterly within thirty days of the end of the respective quarter.

7. On service commissions in the country and abroad. Details should be made of the number of commissions and appointed officials, staff members and staff members, the destination of which is received and the basis thereof and the details of the passages used in such service commissions, and indicate the holder of such fees, destination, value and date, with the exception of those which are reserved, to be reported in secret session. This information will be forwarded quarterly.

8. Contracts and deviations made during each quarter. In both cases, the name, position and title of higher education should be disclosed if any.

In the case of delinkages, the number of staff members and staff members who cease to function in each of the public services to which they relate, the length of office, the date and the cause of cessation should be disclosed.

9. The amounts of monthly money that are implemented directly by the institution, those that are executed through framework agreement, public tendering, private tendering or direct treatment, in each of the programs that constitute the respective heading. This information will be forwarded on a quarterly basis within thirty days of the end of the respective quarter and will include the Treasury Commission of the Chamber of Deputies.

10. The costs associated with workers ' remuneration, with the indication of the legal quality of contracts and the percentages of types of recruitment in relation to the total number of staff, differentiated by gender and by season, the average duration of each contract, as well as the number of times contracted under this modality by the public entity concerned. This information will be transmitted semi-annually and will be included in the Treasury Commission of the Chamber of Deputies.

11. The medical licenses, identifying those that correspond to occupational diseases, the fact that they have been reimbursed, the level of compliance with the obligation of reimbursement and the amounts involved. The information should be detailed on the days of absence and the number of staff and staff members who present licences, differentiated by gender. It will be sent quarterly, thirty days after the respective quarter, and will include the Senate Health Commissions and the Chamber of Deputies and the Budget Directorate.

12. Expenditure associated with the lease of land or other immovable property that will serve as units for the activities of the ministry; which will be reported quarterly, thirty days after the end of the respective quarter, and will include the Senate Housing and Urban Planning Commission, and the Housing, Urban Development and National Property Commission of the Chamber of Deputies.

13. The Ministry of the Interior and Public Security, and the Ministry of Justice and Human Rights will report the possibility of implementing a truth and justice commission on violence committed by State agents to civilians between October and November 2019, which evaluates proposals for redress. The commission shall not replace the functions of the jurisdictional bodies. This information will be forwarded quarterly, and will include the Human Rights and Peoples Commission of the Chamber of Deputies and the Human Rights, Nationality and Citizenship Commission of the Senate.

14. The Ministry of the Interior and Public Security will report on the results of the implementation and development of the Good Living Plan during the year 2022, and the General Secretariat of the Presidency will report on the budgetary planning, objectives and targets of the Good Living Plan for the year 2023, to be forwarded by 31 January 2023. In addition, quarterly, it will report on the projects and initiatives developed, and progress in meeting the goals and targets, and indicate how much the target population coverage of the plan is by commune.

15. During the year 2023, the National Mining Company, created by the Decree No. 153 of 1960 of the Ministry of Financeshall report on the disposal of assets approved by the Board.

16. The Ministries of Public Works, Housing and Urbanism, Health, Education, the Undersecretariat for Regional and Administrative Development and the regional governments will report, no later than January 2023, a payroll with the investment projects identified in accordance with what is established in the article 19 bis of Decree Law No. 1.263 of 1975included in this law. This payroll will contain the name, location by commune and region, state, date of execution and total estimated investment and each of the stages that make up the project, and will specifically specify the works and resources that will be executed during the year 2023. Those financed by sectoral funds from the resources provided for in the funds provided for should be distinguished Law No. 21.288. In addition, as of February 2023, they should send a monthly update report containing, for each of them, their status of progress and the investment materialized during the year 2023.

In addition, State bodies governed by this Act shall comply with the following information and publication obligations:

(a) To publish a quarterly report on its organizational website containing, where appropriate, the individualization of projects benefited from subheadings 24 and 33, payroll of beneficiaries, methodology of choice of beneficiaries, persons or executing entities of the resources, assigned amounts, modality of allocation, financed activities, annual targets and targets, amounts and percentage of implementation, within thirty days of the budget programme; In case of containing coverages and resources allocated in glyse, the information must be presented with such a level of disaggregation.

If the allocations mentioned in the preceding paragraph relate to transfers to municipalities, the respective report should also contain a copy of the agreements signed with the mayors, the breakdown by municipality of the amounts transferred and the criterion under which they were distributed.

The information provided should be forwarded in the same time and in the same detail to the Joint Special Committee on Budgets.

(b) Publish in their respective portals of active transparency the assessment records issued by the commissions evaluating tenders and public procurement of goods and services carried out within the framework of the Law No. 19.886within thirty days of the end of the respective process.

The information must be forwarded to the Joint Special Committee on Budgets on a quarterly basis within thirty days of the end of the respective quarter in the same detail.

(c) Each ministry and other organs of the State Administration shall make available to their respective institutional electronic sites the information relating to the budget allocated by this Act.

To this end, they will seek to use a clear language that will allow for the greatest number of people to be understood, using graphics and other mechanisms to understand, in a simple way, the composition of the budget and the various elements that integrate it, linking this information to the strategic orientations, priority objectives and expected results for the period.

Mechanisms for citizen participation should be contemplated to collect concerns and consult on initiatives under study or for prioritization of future actions, through councils of civil society, of a consultative nature, commensurate with what is established in the article 74 of Decree No. 1-19.653 of 2000 of the Ministry of General Secretariat of the Presidency.

All information should be provided in digital, readable and procedural format, which does not consist only in the image of the respective documentation, disaggregated by sex, where appropriate. Furthermore, any duty of information that does not indicate a date of delivery must be fulfilled before the commencement of the Public Sector Budget Act for the following year.

Any information that, according to the provisions of this law, should be referred to any of the committees of the Chamber of Deputies or the Senate, shall be deemed to be also referred to the Joint Special Committee on Budgets. In the case of the Chamber of Deputies, such information shall be provided through the unit that it determines, for its work and referral to the person requesting it. The Senate Chamber and the Office of Information, Analysis and Budget Advisory shall provide in an electronic repository of public access the information referred in accordance with this law. For this purpose, a web platform may be available, through which the public institutions included in this law shall have the corresponding information.

Without prejudice to the foregoing, the Joint Special Committee on Budgets shall transmit the information appropriate to it to the permanent commissions of the Chamber of Deputies and the Senate whose matters of competence are related to the respective Party within thirty days of receipt.

Any information referred to in accordance with the provisions of this article shall consider the particularities, conditions and disaggregation in force in the Budget Act of 2022.

In order to comply with this article, the information indicated should be made available by the relevant agencies in accordance with the instructions given for this purpose by the Budget Directorate.

In addition, public bodies required to submit the information referred to in this article shall make it available to electronic sites where they comply with the obligations of active transparency. The omission of the publication in the stated form or its lack of updating may be claimed in accordance with the provisions of the article 8 of the Law on the Transparency of Public Function and Access to Information of the State Administration, contained in article 1 of the Act No. 20,285on Access to Public Information.

Article 15.- Please note by 2023 in 6,500 the maximum number of persons who may modify their legal status as an additional fee, associating themselves with the degree of the legal plant of the corresponding station, whose monthly liquid remuneration allows them to maintain their monthly liquid honorary.

In order to carry out the above-mentioned transfers, beginning on 1 January 2023, at the request of the respective services and institutions of the Public Sector, the maximum limit of the staffing set in the respective budget glows of the present Law may be modified, with a compensation equivalent to the number of persons contracted to high-end fees, fixed in the corresponding budget glows, associated with subheadings 21 and 24.

The adjustments arising from the application of this article shall be established by decrees of the Ministry of Finance, as provided for in the article 70 of Decree Law No. 1.263 of 1975and must be informed monthly, within thirty days of the end of the month concerned, to the Joint Special Committee on Budgets. Also, by decrees of the Ministry of Finance issued as stated above, the requirements for transfer shall be established; the manner of determining the monthly liquid remuneration, the monthly liquid honorary and the degree of assimilation to the plant; the prioritization criteria which, at least, shall be established by the chiefs and chiefs of service for the case that there are more staff to fees than quotas available for the transfer; and the other necessary rules for the transfer.

During the year 2023, public bodies and services included in this Act may renew the recruitment of their staff on the basis of fees without being subject to the limitations set out in the Act. article 11 Law No. 18,834, Administrative Statute, the consolidated, coordinated and systematized text of which was established by the Decree No. 29 of 2004 of the Ministry of Finance, or another rule of similar nature that governs the respective public body. In addition, the replacements of staff to fees will not be affected by the limitation noted above.

Article 16.- The Budget Directorate will provide to the Senate and Chamber of Deputies Finance Commissions, the Joint Special Committee on Budgets and the National Congress Library the reports and documents indicated in the form and opportunities indicated below:

1. Monthly budget performance report on income and expenditure of the Central Government, at subtitle level, within thirty days of the end of the respective month.

2. Quarterly budget performance report on income and expenditures of the Central Government, at subtitle level, within thirty days of the end of the respective quarter, including in annexes a breakdown of the tax revenues of the period, other sources of financing and gross debt balance of the Central Government. In the same way, it should include in annexes information of the expenditure accrued in the Central Government of Subtitle 22, item 07, Advertising and Dissemination, disaggregated by allocation, detailing the expense by Partida and its actual variation in respect of the same quarter of the previous year and the allocations included in Subtitles 24 and 33, for each of the programs of this law.

3. Report on the quarterly implementation of the income and expenditure budget for the Partitions of this Law, at the level of Partitions, Chapters and Programs approved for each of them, structured in initial budget, current budget and amount executed to the respective date, including the expense of all the glows of this law, within thirty days of the end of the respective quarter.

4. Copy of the decrees of totally processed budget modifications for each month and a consolidated report of the budgetary modifications made in that month by Partida, containing a description indicating whether it is an increase by application of laws, reductions by fiscal adjustment, or modifications by policy decisions, specifying the amounts increased or decreased by Subtitle and Partida, within thirty days of completion.

5. Semi-annual report on the gross and net public debt of the Central Government with its explanatory notes and supplementary record, within sixty-nine days of the end of the corresponding semester, respectively.

6. Copy of loan contracts that are signed with multilateral agencies in the use of the authorization granted in Article 3 within fifteen days of the total processing.

7. Quarterly report on the Financial Assets of the Public Treasury, within thirty days of the end of the respective quarter.

8. Quarterly report on the Pension Reserve Fund and the Economic and Social Stabilization Fund, within 90 days of the end of the respective quarter.

9. Quarterly report of asset and liability risk coverage operations authorized in the article 5 of the Law No. 19.908within thirty days of the end of the respective quarter.

10. Quarterly report with the update of the fiscal scenario that considers a projection of income and expenses, together with the corresponding projection of the effective and cyclically adjusted balance, the projection of debt and the net financial position for 2023 and for the financial program in each case, additional to the Public Finance Report established in the number 22 of the Article 2 of Decree No. 106 of 1960 of the Ministry of Finance.

11. Background on the strategic planning of State administration bodies, including ministries and their respective decentralized bodies, regional governments and public services. Such backgrounds should include at least:

(a) Strategic definitions, identifying the priorities of such agencies through strategic objectives and linking them to ministerial objectives. Similarly, planning should allow the identification of the main goods and services provided within the scope of each objective.

(b) Performance indicators, to measure progress in the achievement of institutional strategic objectives.

These records will be forwarded in database format, in July, with respect to the Executing Budgets Act. The same background should be forwarded during the first fifteen days of October, in respect of the Public Sector Budget Bill for the following year.

In order to comply with the above points, the information indicated should be delivered by the relevant agencies in accordance with the instructions given for this purpose by the Budget Directorate. In addition, such information should be published in the same time period in the respective electronic sites of the agencies required to provide it.

During the month of March 2023, a coordinating body will be formed between the two chambers of the National Congress and the Budget Directorate, for the purpose of agreeing formats and clarifications regarding the information in which this article is concerned.

Article 17.- The public bodies and services included in this law will require prior authorization from the Ministry of Foreign Affairs and the Ministry of Finance, to join or associate with international agencies, renew existing affiliations or agree to increase their quotas. In the event that the incorporation or renewal requires them to make contributions or contributions or increases of these and if the agreements consist of increases in the amount of quotas, their visa will be conditioned on the budget availability, which will be verified by the Budget Directorate.

Article 18.- The supreme decrees of the Ministry of Finance to be issued in accordance with the provisions of the various articles of this law and those corresponding to the budget execution shall be in accordance with the provisions of the law article 70 of Decree Law No. 1.263 of 1975.

The approvals, visas and authorizations of the Ministry of Finance established by this law, the granting of which is not expressly required to be carried out by supreme decree, the authorizations prescribed by the articles 22 and 24 of Decree Law No. 3.001 of 1979the final sentence of the second paragraph article 8 of Decree Law No. 1.056 of 1975; the article 4 of the Act No. 19,896, the article 19 of the Law No. 18.382the exception referred to in the final subparagraph article 9 of the Act No. 19.104 and article 14 of the Act No. 20.128shall be carried out by office or visa of the Budget Authority, which may delegate such powers, in whole or in part.

Visas arranged in the article 5 of the Act No. 19,896 shall be carried out by the respective Undersecretariat or Undersecretary, who may delegate such authority to the relevant secretary or regional ministerial secretary.

Article 19.- Those responsible for the budgetary programmes provided for in this law who are recruited to fees shall have the quality of public agents, with the consequent criminal and administrative responsibility, without prejudice to the corresponding responsibility of their superior officer.

Article 20. When public bodies and services carry out public information and publications in the social media, they shall, at least 40 per cent, be made in the media with clear local identification, distributed in a territorially equitable manner. This percentage may not be used for means that are part of conglomerates, holdings or media chains, with which they relate in the terms of the articles 99 and 100 of the Law No. 18.045that have headquarters or branches in more than one region.

The publication obligations set out in the preceding paragraph shall be subject to the provisions of the preceding paragraph. article 7 of the Law on the Transparency of Public Function and Access to Information of the State Administration, contained in article 1 of the Act No. 20,285at least the following information shall be made available: total amount and breakdown of the expenses in the warning and advertising, identification of suppliers (social and rut reason), type of media (television, radio, press or other), territorial identification (local, regional, national), membership or not a holding, conglomerate or communication chain. This information will tend to be published in open and reusable data format, so as to enable and facilitate access to and use of this background by citizens. It shall be up to the Council for Transparency to provide instructions on the fulfilment of the obligation contained in this paragraph.

The public bodies and services referred to in this article shall, no later than March 2023, submit their annual planning for the inspection and publications to the Ministry of Government ' s General Secretariat, according to the format and guidelines to be provided in a timely manner by the Ministry, which shall monitor the fulfilment of the obligation set out in the preceding paragraph.

Article 21.- Publicity and publicity costs that may be executed from each Budget Part during the year 2023 may not exceed the amount set in the respective budget.

In this regard, in December 2022, each ministry shall send to the Budget Directorate the distribution of these resources, by the Budget Programme. Such distribution shall be fixed in respect of each budget programme by decree of the Ministry of Finance, issued under the formula established in the article 70 of Decree Law No. 1.263 of 1975. A copy of this decree, fully processed, must be sent to the Joint Special Committee on Budgets.

Similarly, the amount allocated to a budget programme for publicity and dissemination costs may be increased from the decrease of another or others, but the total amount set for the Party may not be increased by this means.

The appropriate publicity and publicity activities carried out by ministries, regional presidential delegations, provincial presidential delegations, regional governments and public bodies and services that make up the State Administration shall be subject to the provisions of the article 3 of the Act No. 19,896. In no case may publicity campaigns be carried out with the sole purpose of enumerating the achievements of a specific authority or of the Government in general, with the exception of the public accounts that the agencies mentioned in this article undertake.

For this purpose, it will be understood that they are advertising and dissemination expenses for the performance of the functions of the said agencies, those necessary for the proper development of recruitment processes; access, communication or social benefit-accounting, such as exercise of rights or access to fellowships, grants, credits, bonds, monetary transfers or other programmes or services; guidance and education of the population for emergencies or public alarming situations; and, in general, imposes on those costs.

The agencies referred to in this article may only edit memoirs and other publications by electronic means, unless the law expressly states that they should be published in printed media. They may not incur costs for the development of institutional promotional articles. Expenditure for subscriptions to journals, journals and information services, both on paper and electronic means of data transmission, should be limited to that which is strictly essential for the delivery of services.

Article 22.- Service commissions in the country and abroad should be reduced to those that are essential for the performance of institutional tasks, especially those abroad, which may not exceed two persons per activity. Exceptionally, the Budget Authority may authorize the service to a service commission greater than the number indicated, when it is provided with substantial grounds.

Except for justified reasons, or in the case of ministers and ministers of State, tickets must be purchased at least seven working days in advance.

Only the President of the Republic and ministers and ministers of State in service commissions abroad may be accompanied by communicatives. In the case of ministers and ministers, these compositions shall be composed of a maximum of two companions, with the exception of the Minister or the Minister for Foreign Affairs, who may be accompanied by a maximum of three persons.

State, official or working visits, in which the President of the Republic or ministers and ministers of State convoke as part of the delegation members of the National Congress, ministers and ministers of the Supreme Court, the Comptroller General of the Republic or other senior authorities of the State Administration, shall be considered service commissions of interest to the country ' s foreign policy. In no case can this mean duplicity in the payment of vitics.

The lease of infrastructure for institutional activities, such as meetings, planning days or similar ones, should be authorized only to the extent that the respective service does not have its own infrastructure, nor can it be provided by another public service.

Public services shall make all necessary arrangements to recover, from the previsional health institutions, the amounts corresponding to medical leave allowances, within the maximum period of six months from the date of payment of the respective monthly remuneration, and to enter them into general income of the Nation. For such purposes, the General Treasury of the Republic shall issue general technical instructions to carry out these processes.

The provisions of the preceding subparagraphs will also apply, as appropriate, to State enterprises, including Chile ' s National Television, Chile ' s National Copper Corporation and Chile ' s State Bank, and to all societies in which the State, its institutions or companies have a capital contribution equal to or greater than fifty per cent.

Article 23.- The competition shall be compulsory for the allocation of resources for current transfers to private institutions, unless the law expressly states otherwise.

Without prejudice to the provisions of its specific regulations in accordance with the law, current transfers to private institutions must always meet the following requirements:

(a) They shall be transferred through an agreement signed between the parties, in which the actions to be developed, the goals, deadlines and ways to account for their use shall be stipulated at least.

The Ministry of Finance may provide supplementary general application instructions on the content of these conventions, in order to ensure that the public resources transferred are effectively intended for the purpose for which they were assigned, as well as their restitution, if not.

(b) The conventions may not consider transfers of all or part of what is agreed upon within a period other than that resulting from linking such transfers with the actual progress of the implementation of the initiatives during the budget year, unless authorized by the Budget Directorate.

(c) The conventions may not establish commitments that exceed the budget period unless they have prior authorization from the Budget Directorate.

(d) Private institutions that receive public funds, for any reason, in a total amount of more than two thousand tax units per month, shall publish the conventions on their website, together with their financial statements, balance and annual memory of activities.

Fund-receiving institutions that do not comply with the obligations of the Law No. 19.862 they may not receive public funds established in this law, but until such time as this is resolved.

Public bodies responsible for the transfer of resources shall ensure compliance with the provisions of this article. Failure to comply, either with the provisions of this Act, with the instructions set out in the second subparagraph (a) of this article, or with the terms of the respective conventions, shall have the impossibility of making any new transfer of public resources to the respective private institution until such time as the situation is resolved. The foregoing, without prejudice to any administrative liability arising from this breach in the responsible institution.

Public ministries and services shall safeguard the registration of relevant information Law No. 19.862. They should also publish information on transfers, in accordance with the terms of letter (k) article 7 of the Law on the Transparency of Public Function and Access to Information of the State Administration, contained in article 1 of the Act No. 20,285on Access to Public Information.

In the case of consolidated transfers between agencies of the public sector, these may be carried out without the need for the subscription of an agreement by the agencies involved. The foregoing, without prejudice to the provisions of the applicable glows of this law or the powers of the heads of service in this regard.

Article 24. The Ministry of Finance will be able to provide general instructions on cash budget, indebtedness and investment projects; and specific, on foreign travel, advertising and corporate responsibility expenses, applicable to all State companies, including Chile's National Television, Chile's National Copper Corporation and Banco del Estado de Chile, and to all those companies in which the State, its institutions or companies have a capital contribution equal to or greater than fifty percent.

Copy of these instructions will be sent to the Joint Special Committee on Budgets no later than thirty days after they are issued.

Article 25.- Officials and civil servants regulated by Act No. 18,834, Administrative Statute, the consolidated, coordinated and systematized text of which was established by the Decree No. 29 of 2004 of the Ministry of Financethe President of the Republic, ministers and ministers of State, undersecretaries and undersecretaries, regional governors and governors, regional delegates and presidential delegates, and heads and senior heads of public services governed by the Part II of Law No. 18.575, Constitutional Organization of General Bases of the State Administration, whose consolidated, coordinated and systematized text sets the Decree No. 1-19.653 of 2000 of the Ministry of General Secretariat of the Presidencyshall not be entitled to a diet or remuneration derived from the integration of councils or boards of directors, chairs, vice presidents, directories, committees or other equivalents with any nomenclature, of companies or public entities that increase the remuneration for the positions regulated by the laws mentioned.

Article 26.- The maximum number of motorized vehicles set out in the Partitions of this law for public services includes all those for ground transportation of passengers and cargo, including those purchased directly from investment projects. The strength may be increased in respect of any of these, by decree dictated in the manner laid down in the article 70 of Decree Law No. 1.263 of 1975from the decrease in the maximum strength of other such services, without any increase in the maximum strength of the ministry concerned. The respective supreme decree shall have the transfer of the or the corresponding vehicles from the Service in which it is diminished to that in which it is increased. For this purpose, the vehicles must be properly identified and the decree will provide sufficient title to transfer their domain, and must be registered with the Register of Motor Vehicles of the Civil Registration and Identification Service.

Article 27.- The organs and public services of the Central Government included in this law may make payments imputable to Subtitle 34, item 07, Fleet Debt, as well as spins imputable to Subtitle 25, item 99, Other Integrity to the Fisco, exceeding the amounts set there, in the terms specified in the article 28 of Decree Law No. 1.263 of 1975. For this purpose, the amounts established in the respective allocations may be exceeded and subsequently punished by decrees of the Ministry of Finance issued in the manner provided for in the article 70 of the decree.

Article 28.- Any information that, in accordance with the articles of this law and in the respective glows, should be made available by any organ of the State Administration, and mainly, by the ministries and the Budget Directorate, to the various instances of the National Congress, will be provided only in digital and procedural format by data analysis software, that is, in calculation tables or flat text files.

Failure to comply with any of the duties of information contained in this law will result in the procedure and penalties established by the law article 10 of the Act No. 18,918constitutional organ of the National Congress.

For this purpose, and at the request of any deputy or senator, the President or the President of the Chamber of Deputies or the Senate shall refer the background to the Comptroller General of the Republic. Such action should be taken at the respective meeting.

Article 29.- The provisions of this Act shall rule on 1 January of the year 2023, without prejudice to the fact that the decrees referred to in article 3 may be issued on the date of publication, and the decrees, resolutions and conventions required under this Act to enable budgetary execution. This law and instructions for its implementation may be published in its entirety for distribution.

Article 30.- Registration of contractors and suppliers of the Administration referred to in the articles 16 and 17 of the Law No. 19.886, of Administrative Contracts for Supply and Servicing, shall contain the individualization of natural and legal persons who, in any capacity, participate in the ownership and administration of the legal person registered in that registry.

The Public Procurement and Procurement Authority shall request the information provided within sixty days of the publication of this law, in order to adapt the registration to the requirements set out in this article.

Article 31.- Authorize the Fisco to comply with the obligation contained in the third transitory article of the Act No. 21.174which establishes a new mechanism for financing the strategic capacities of the national defence, with respect to the Strategic Contingency Fund of the National Defence Act, until December 31, 2023.

Article 32. For the purposes of the reserved expenses allocated for the year 2023, the written report to the Office of the Comptroller-General of the Republic, pursuant to paragraph 3 of article 4 of the Law No. 19.863must be jointly subscribed by the chief or the chief of service and the chiefs and heads of the operating units that are charged with reserved expenses, must also count on the good looks of the minister or the respective minister, indicated in the second paragraph of the said article.

The report referred to in the preceding paragraph should have sufficient information to enable the Comptroller-General of the Republic to verify that it has been fulfilled for the purposes set out in the preceding paragraph. article 2 and the provisions of the article 6 of the Law No. 19.863.

Article 33.- During the year 2023, the disposal of real estate that forms part of the tax-related assets of the Army Military and Engineering Command and the Armed Forces Welfare Services will require the visa of the Ministries of National Defence and the Ministry of National Property. With regard to the properties that form part of the tax-impacting assets of the Military and Engineering Command of the Army and the Carabineros Welfare Service of Chile and the Chilean Police Chief of Welfare, they will require a visa from the Ministry of the Interior and Public Security and the Ministry of National Property. These disposals should be informed, previously, by the Ministry of National Defence or by the Ministry of the Interior and Public Security, as appropriate, to the Ministry of Housing and Urbanism and the Joint Special Budget Commission.

Article 34. Modify Article 4 of the Act No. 20,765which creates fuel price stabilization mechanisms, as follows:

1. Replace the phrase "and from its entry into force" for ", as of January 1, 2023".

2. Replace the expression "US$3 billion" for "US$1.5 billion".

Article 35.- During the year 2023, the sum of the amounts involved in financial risk coverage operations by the entities authorized in the article 5 of the Law No. 19.908, may not exceed $40,000 or its equivalent in national currency. Such operations shall be carried out subject to the provisions of the aforementioned legal rule.

And for I have had it good to approve and punish it; therefore, promute and take it into effect as the law of the Republic.

Santiago, December 7, 2022.- GABRIEL BORIC FONT, President of the Republic.- Mario Marcel Cullell, Minister of Finance.

What I write to you for your knowledge.- Greetings Atte. to you, Claudia Sanhueza Riveros, Undersecretary of Finance.